Pent-up demand on secondary market expected post-moratorium

The secondary, or sub-sale, property market is expected to remain steady despite the soft economic conditions. But there is concern among homebuyers and investors that property prices and activity will be subdued in both the primary and secondary markets when the moratorium on loan repayments ends.

It may seem counterintuitive, but market activity has actually been on an upward trend, albeit from a low base, since the Recovery Movement Control Order (RMCO) was implemented and the sub-sale market appears to be leading the way.

Is Malaysia on the cusp of a swift recovery?

Property consulting firm, Firdaus & Associates Property Professionals founder and managing director Sr Firdaus Musa told Property Advisor, “With all the sweeteners being offered, aggressive real estate negotiators marketing products and the realisation of the necessity of owning a property after months of being cooped up, the sub-sale market has gone into a frenzy, but this will taper off.”

The secondary market enjoyed a run immediately after the RMCO was implemented. Reality will kick in once the moratorium on loan repayments ends, but it will be mitigated by an expected increase in auction properties and purchasers looking for better deals.

Real estate consultancy ExaStrata Solutions Sdn Bhd CEO Adzman Shah Mohd Ariffin said demand for properties appears to have picked up since May with increased demand for terraced houses in the suburbs on the sub-sale market.

“Prices in sought-after areas have also been adjusting and are now more appealing to buyers. The spare cash available during the moratorium may have been used for down payments.”

He believes homeowners want to take advantage of the exemption on Real Property Gains Tax for up to three properties and see a need for financial consolidation following the effects of the pandemic on the economy and businesses.

“Buyers are driven by lower interest rates and the removal of the 70% loan margin limit for the third property purchase for RM600,000 and above.”

Hartamas Real Estate (M) Sdn Bhd managing director Eric Lim agrees that the demand on the secondary market has been good for the past three months.

“In terms of outlook, it will be moderate to mildly bullish. Borrowing cost is at an all-time low and supply is reducing owing to limited launches.

“Except for certain sectors, most of the economy is almost back on track. Those who are unemployed are slowly being hired in other sectors.”

In terms of momentum, Lim said there would be mixed reactions and a wait-and-see approach.

“Some may remain on the sidelines to gauge the effect of the end of the moratorium. However, with the Home Ownership Campaign in progress, greater demand and participation may be expected towards the later part of the campaign.”

Demand high for sub-sale houses

According to Firdaus, the demand is highest for apartments and landed residential properties priced at RM500,000 and below, with scattered purchases of properties priced above RM1 million.

However, ExaStrata’s Adzman said the secondary market, especially high-rise strata properties, is facing fierce competition from new launches that are mostly priced below RM400,000.

“It is anticipated that once borrowers resume payments, transactions for sub-sale properties may slow down and terraced houses will be most in demand.”

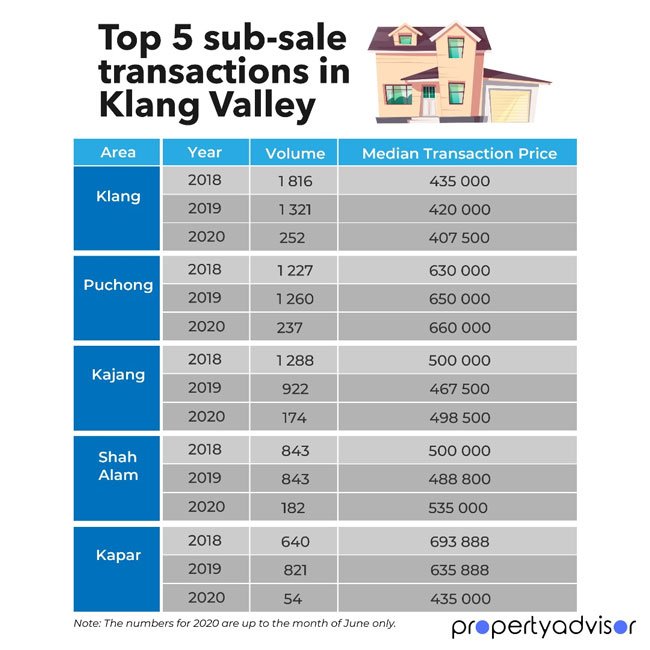

Property Advisor’s analysis showed that Klang had the most secondary-market transactions in 2018, with 1,816 in total. The number decreased by 27.26% to 1,321 transactions last year.

The median price, however, did not see such a drastic change – it decreased by 3.45% to RM420,000 last year, from RM435,000 in 2018.

Similar to Puchong, Kapar’s transaction volume increased by 640 in 2018 and rose to 821 last year, an increase of 28.28%. Unlike Puchong, the median price for Kapar depreciated 8.36% to RM635,888 last year from RM693,888 in 2018.

In Kajang, there was a dramatic decrease in transactions of 28.42% to 922 last year, from 1,288 in 2018. The median price in Kajang also decreased by 6.5% to RM467,500 last year from RM500,000 previously.

Interestingly, the volume of transactions in Shah Alam remained unchanged from 2018 to 2019, at 843 during both years. However, the median price decreased 2.24% to RM488,800 last year from RM500,000 in 2018.

Kapar’s transaction volume, meanwhile, increased by 640 in 2018 and rose to 821 last year, an increase of 28.28%. The median price for Kapar depreciated 8.36% to RM635,888 last year from RM693,888 in 2018.

Impact on the banking sector

With nearly 800,000 people unemployed, the number of non-performing loans (NPL) will rise as borrowers have not serviced loans for more than three months, the Department of Statistics Malaysia says.

Firdaus said mortgage applications would remain high, but may be hampered by low approvals.

“However, we can see slow easing by the banks in terms of approvals, or more detailed submissions by applicants to ensure approval,” he said.

Meanwhile, Adzman noted that home loan approvals have reportedly contracted on a year-on-year basis as more purchases are expected for new launches than for sub-sale properties.

This article was written by Sharina Ahmad of PropertyAdvisor.my, Malaysia’s most comprehensive source of property data, property analytics and insights.

Source: FMT News

POST YOUR COMMENTS