Kajang, an emerging hot spot for affordable living

A small township in the eastern region of Selangor, Kajang is located about 21km from the bustling city centre of Kuala Lumpur.

It is the district capital of Hulu Langat and has seen significant growth since its tin mining days due to its proximity to the city.

Kajang is also included as part of the Klang Valley or Greater Kuala Lumpur.

The name “kajang” comes from the woven palm leaves that were used to cover the roofs and walls of the Javanese and Sumatran settlers’ houses – dating as far back as the 1850s – when they set up home along the Langat River.

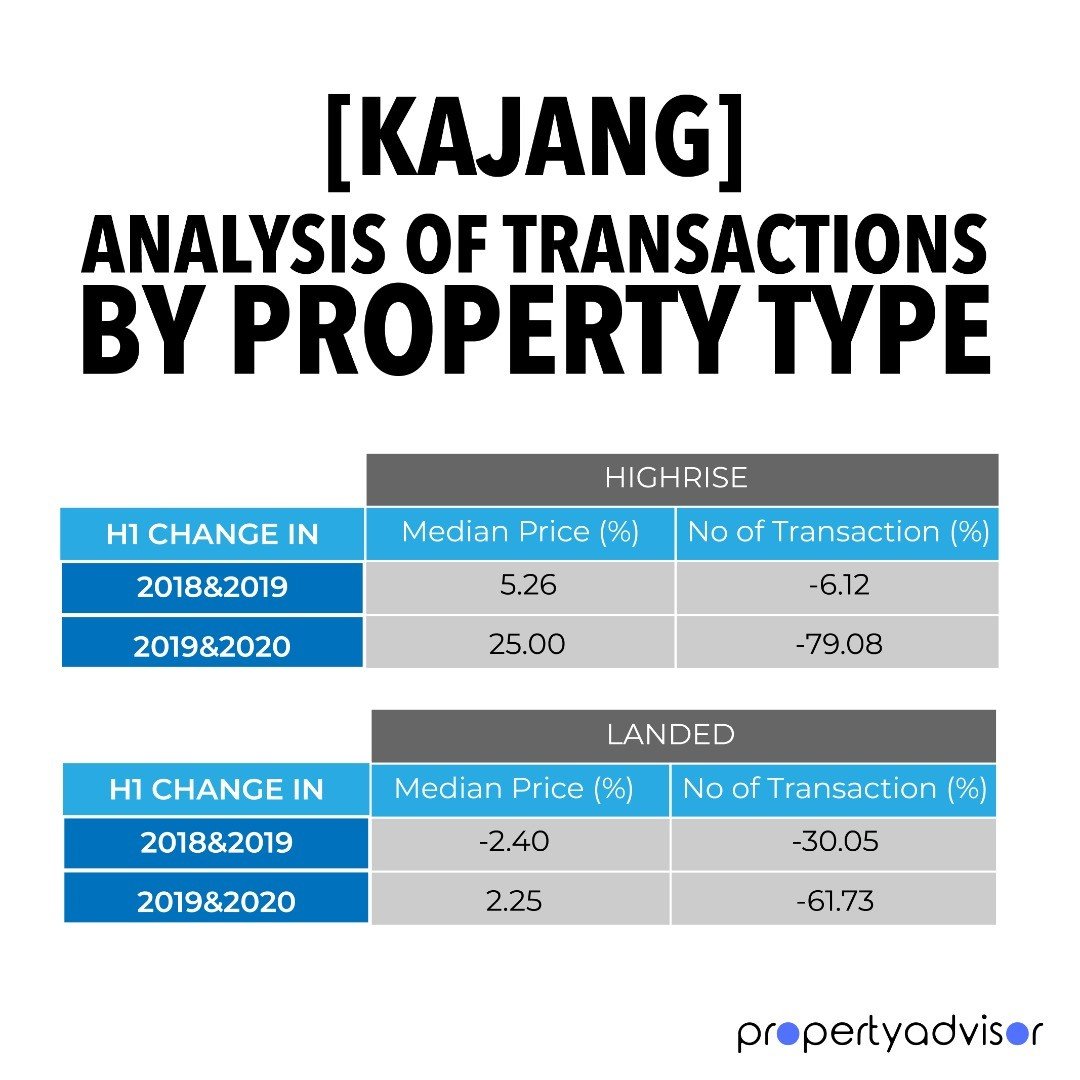

From the first half of 2018 (1H2018) to 1H2019, the transaction volume for high-rise residences in Kajang fell 6%. This year, due to the Covid-19 pandemic, transactions continued to drop, resulting in a 79% plunge from 1H2019 to 1H2020.

It is worth noting, however, that the price trend for high-rise residences in Kajang was on the rise during the same period. In 1H2019, it experienced an increase of 5% as compared with 1H2018, and in 1H2020, the price surged by another 25% despite the reduced transactions.

For landed properties, prices had dipped 2.4% from 1H2018 to 1H2019 but went back up in 1H2020 by 2.2%, bringing the price back to similar levels as in 2018.

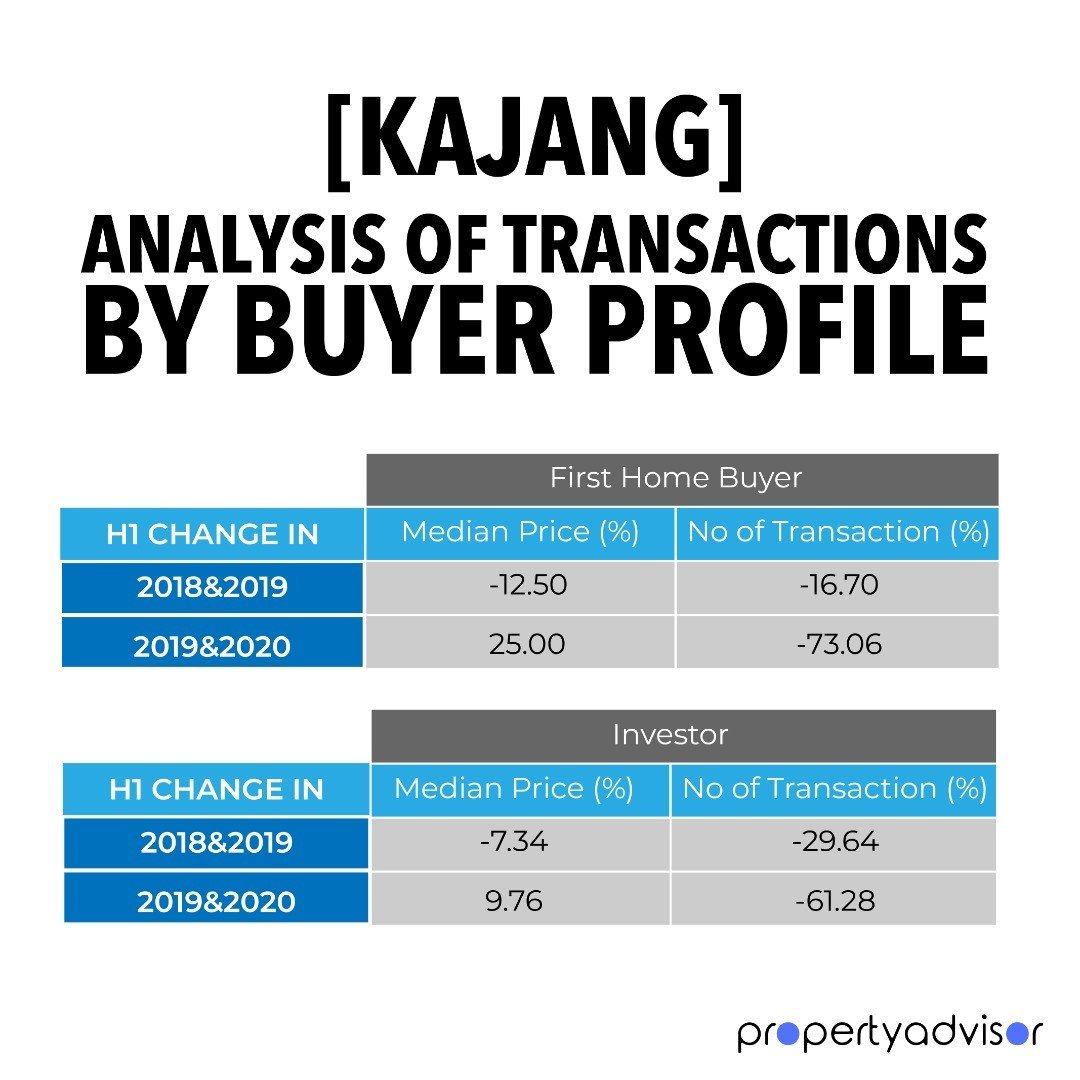

This is after a drop in median prices in 1H2019 compared with 1H2018. The median price for FHBs dropped 12.5% in 1H2019, but in 1H2020, it spiked by 25%, despite a 73% drop in transactions.

For the investors market, the change in prices was not so dramatic but still showed a marked difference. In 1H2019, median prices were 7% lower but increased by nearly 10% in 1H2020.

What does the expert say?

The Roof Realty Sdn Bhd real estate senior negotiator Regina Ng told Property Advisor that people are now moving from the city centre to the southern area.

“The need for education and medical centres is greater in this area. As you can see, people have started to move to Kajang and Cheras although these areas are not too close to the city centre.

“It is due to the lower cost of living there compared with the town area. Education and medical centres are playing an important role in boosting this area.”

Ng also said the Kajang railway station is the principal rail station in the area. It functions as the interchange for the mass rapid transit (MRT) Sungai Buloh-Kajang Line, Seremban Line and KTM ETS. The station is the southern terminal of the MRT line.

“Kajang station, though so named, does not directly serve downtown Kajang. Stadium Kajang MRT station is located in the actual downtown area, along with the Sungai Jernih MRT station.

“Although Kajang has public transport such as the MRT, there are still some areas that do not have very good public transport facilities,” Ng said, adding that the parking lots around the MRT stations are insufficient, resulting in commuters parking their cars by the roadside.

Kajang is served by a network of tolled expressways and federal highways, including the main north-south highway of Peninsular Malaysia, which runs through downtown Kajang and then south to Johor Bahru.

A stretch of highway runs parallel with the Cheras–Kajang Expressway between Cheras Sentral Mall and Taman Koperasi Cuepacs.

The Kajang Dispersal Link Expressway starts in Seri Kembangan and runs through Balakong, forming a beltway around downtown Kajang before ending near Bangi.

Ng said the highest demand is for landed property in Kajang but there are fewer new developments for landed property in the mid-price range.

“Since there are fewer landed properties being developed in this area, people opt for sub-sale instead.

“There are many high-rise developments along the road to the Cheras-Kajang highway, but most were purchased for investment purposes and the rents currently hardly cover the instalments. The price per sq ft for high-rises is about RM500 to RM650.”

Source: FMT News

POST YOUR COMMENTS