A more positive outlook for property sector in 2H23

Analysts are optimistic, expecting a positive outcome with increased buying activities, while staying cautious on a possible OPR hike before year-end

by AUFA MARDHIAH

THE first half of 2023 (1H23) witnessed the property market in a tight spot between buyers’ resistance towards higher prices and sellers’ struggle to sell in light of the poor economic outlook.

Analysts however are optimistic about the market in 2H23, expecting a positive outcome with increased buying activities. They nonetheless remain cautious about the possibility of an Overnight Policy Rate (OPR) hike before the end of the year.

International Real Estate Federation (FIABCI) president Datuk Sr Firdaus Musa said Malaysia’s property market for 2H23 will have a positive outlook despite the moderately lower economic growth due to external factors.

He said that the property market was in a recovery mode in 2022, while 2023 remains a recovery and rebound year with a mix of positive and negative aspects.

This is a result of the property market experiencing an increase in market activity due to the ease of pandemic restrictions and the resumption of economic activities.

Buyers who were previously hesitant to purchase property may grow more confident, resulting in a gradual recovery in transaction volumes.

According to Bank Negara Malaysia (BNM) figures, loan applications for property acquisition climbed by 26.6% month-on-month (MoM) in February 2023, following a five-month decline.

This shows that loan applications reversed its declining trend and reached its peak in six months.

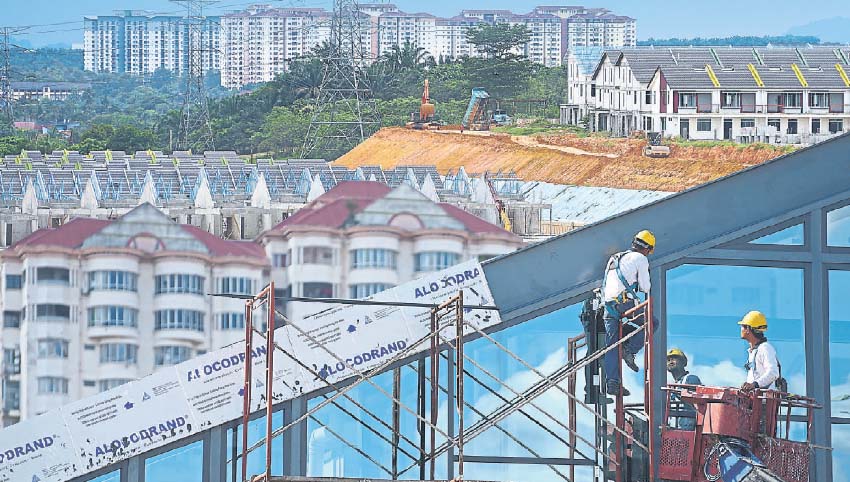

The problem of overhang properties can be solved holistically by improving access to financing and offering discounts (pic: Muhd Amin Naharul/TMR)

For all properties in the sub-sector, residentials contribute the most to the transaction volume in an uncertain property market.

Firdaus said Malaysia’s residential market is upbeat, with a major increase and modest expansion since last year.

However, only around 54,000 residential property transactions were recorded in the first quarter of 2023 (1Q23), representing a 6.6% decrease in market activity compared to 1Q22 attributed to an increase in the OPR, as well as a 9.7-point year-on-year (YoY) decline in the Consumer Sentiment Index.

For commercial segments, the market is still battling to recover from the pandemic’s impact, particularly in terms of rental and occupancy rates.

According to the National Property Information Centre (Napic) 1Q23 report, the occupancy of private purpose-built offices and shopping complexes has improved modestly.

The purpose-built offices had an occupancy rate of 71.9%, slightly higher than in 4Q22, while the amount of unoccupied office space remained high at 5.17 million sq m.

Meanwhile, shopping complexes had an occupancy rate of 76% in 1Q23, with approximately 4.2 million sq m of total unoccupied retail space.

As for the industrial property market, Malaysian industrial property sales amounted to approximately RM5.02 billion in 1Q23 and the market is likely to expand further as demand for more advanced industrial buildings develops.

The rapid growth of the e-commerce sector has increased demand for industrial buildings, particularly those with adequate logistics and warehouse units.

Furthermore, growing industry knowledge of the importance of ensuring compliance with environmental, social and governance (ESG) standards is crucial in navigating the shifting demand for industrial property infrastructure.

“Property market outlook for the year 2024 is expected to have a positive vibe amid the challenging economy. The constant OPR hike will dampen the current property supply and recovery phase although from the economist’s perspective, the decision is to curb the inflation.

“The recovery period will be extended until 2024 for us to actually see the growth in the property subsector, provided there are sufficient government initiatives to stimulate and reform the economy in order to increase the stability and demand for property transactions,” he said to The Malaysian Reserve (TMR).

On the other hand, Asiacap Valuers & Property Consultants Sdn Bhd MD Kit Au Yong is cautiously optimistic towards certain sectors for the rest of 2023, namely residential and industrial.

He told TMR that there are indications of more active increase in demand for rental of condominiums in the Kuala Lumpur (KL) city centre area, as well as some increased interest in purchase for owner-occupier usage, particularly for landed residential properties and affordable housing subsector.

According to Tong, property outlook in Malaysia is anticipated to be better in 2H23 and is likely to spill over into 2024

Meanwhile, the high-rise sub-sector remains well supplied.

Kit added that the demand for the industrial sector continues to stream in, while occupancy rates are increasing in recent months for hotels due to the normalisation of travel schedules.

Meanwhile, for office sectors, although most companies’ work-from-home (WFH) arrangements have been reversed, the sector is somewhat cautious due to the trend of fewer space requests.

Real Estate and Housing Developers’ Association (Rehda) president Datuk NK Tong said in a written statement to TMR that property outlook in Malaysia is anticipated to be better in 2H23 and is likely to spill over into 2024, which is possibly due to concerns in 1H23 of the possible resurgence of the pandemic (due to the reopening of China) which did not happen.

Furthermore, he added that 2H23 and 1H24 are likely to be more buoyant including the completion of the state elections, which will remove any uncertainty or the “wait-and-see” attitudes.

Fear of OPR Hike

Despite an unchanged OPR rate of 3% announced by BNM recently, the anticipation for a hike reflects a negative view on the property outlook.

Malaysian Industrial Development Finance Bhd (MIDF) in its 2H23 outlook anticipated a sluggish loan application which may dampen the demand of property buying.

Furthermore, the bank also anticipated an increase of another 25 basis points (bps) before year-end, which thus, will modestly reduce interest in purchasing property.

“The possibility of an OPR hike is slightly negative for the property industry, as higher interest rates are projected to reduce buying interest in properties due to higher housing loan instalments.

“For a RM500,000 property loan, we predict that every 25bps increase in interest rate will raise monthly payments by RM60 to RM70,” it said in the report.

Additionally, Kit highlighted that the pause in the rate increase has provided some relief to the real estate market. However, he advised caution, noting the need for policymakers to manage inflation, prices and adapt to global market conditions, including fluctuations in interest rates and currency exchange rates in other countries.

“It is hard to comment, though it looks like good news for now, but it really depends on a couple of key economic indicators as mentioned on top of our country’s economic performance in terms of growth,” he said.

On the other hand, Tong said the OPR rate will likely moderate due to the US Federal Reserve (Fed) already signalling a slowdown, on top of a pause of interest rate hikes for the remainder of 2023.

Buyers’ Concerns for 2023

Commenting on this, Kit said buyers should continue to look selectively into the properties they are buying into by assessing the purpose of their purchase.

This may be for investment or personal use, long or short term, type of property, potential yield, location and all other factors that influence demand and supply beyond the immediate term.

Nevertheless, real estate can be an excellent inflation hedge for Malaysian market, as seen from real estate prices growing over time if the owners purchase and keep the right properties.

For this, he highlighted that renting gives several advantages to tenants, such as more mobility, immediate use, capital investment and simplicity of property management.

Owning a property, on the other hand, comes with a sense of ownership and to some extent, social prestige.

“Knowing what one wants and needs while measuring one’s own financial capability will make it easier to decide as owning a property is a longer-term commitment,” he added.

Investment Opportunity and Trends in 2023-2024

On investment opportunities, Kit said prime location properties continue to appreciate over time while experiencing some short-term fluctuations.

Meanwhile, the potential for growth in new locations may exist, but it is important to note that it may take a longer time to materialise. The realisation of this growth also depends on the pace of future development, which is currently uncertain.

Tong said a continual investment in public transport infrastructure, such as mass rapid transit (MRT) lines and new highways will present new opportunities for growth in the property market.

Nonetheless, he said the main challenge for any property outlook is that of the broader economy and considering Malaysia is an exporting nation, the economy will be closely linked to the global and US economic health.

“So far, the US economy has been very resilient in the face of the Fed’s rate hikes, and with the Fed signalling a pause to come, any concerns there should be abated, making it a more positive outlook for the Malaysian economy, and therefore the real estate market,” he added.

In terms of the property investment trends in Malaysia for 2H23 to 1H24, Firdaus said it reflects a combination of affordability, sustainability, technology integration and government initiatives.

“Traditionally, investors choose to invest in residential as the income rental is secured and provides a steady stream of cash-flow. However, in recent years, mixed-use developments, combining residential, commercial and retail components, have gained prominence in Malaysia.

“These developments offer convenience and a range of amenities within one location, catering to the evolving preferences of residents and attracting investors seeking integrated properties,” he said.

Malaysia’s residential market is upbeat, with a major increase and modest expansion since last year, says Firdaus (source: firdausassociates.com)

Moreover, Firdaus predicted an increase in interest towards co-living and co-working spaces as the sharing economy has influenced the Malaysian property market.

According to him, the trend has grown in popularity among millennials and digital nomads, creating opportunities for investors to study the segments in response to changing tenant needs and tap into prospective rental demand to recoup post-pandemic income.

Meanwhile, he foresees a focus on sustainable and green developments for the industrial and commercial sector as the growing environmental awareness, sustainable and green developments are gaining traction in Malaysia.

“Investors are increasingly considering properties with green features such as energy efficiency, eco-friendly materials and green spaces.

“These properties align with sustainability goals and may attract environmentally conscious tenants or buyers,” Firdaus added.

Property Overhang

With growing concerns on property overhang or unsold property in Malaysia, the sector’s continuous development somewhat worsens the situation and this requires serious and resolute intervention from the government.

Firdaus highlighted several factors contributing to the property overhang issue in Malaysia, including the imbalance housing supply and demand that is more than market absorption due to some developments that are unfavourable in terms of location and are far from the local target market; mismatch between affordable home prices and household income; tight credit availability from financial institutions; as well as the housing tastes and preferences of the younger generations who prefer renting due to worries about flexibility and debt-free living.

Nonetheless, he said the problem could be solved holistically by improving access to financing, which is important for both developers and homebuyers; offering discounts on overhang properties; and identifying specific buyer segments that may find overhang properties appealing.

Other solutions can also include educating the public about the potential for future value appreciation of overhang properties.

This article first appeared in The Malaysian Reserve weekly print edition

Source: The Malaysia Reserve

POST YOUR COMMENTS