Make 2021 the year you build your property portfolio

Property investment is generally considered one of the most effective and reliable ways to generate income.

It is also a good way to diversify your portfolio as property investment offers many other benefits, including cash flow, tax advantages, leverage and appreciation.

If done correctly, real estate investment provides a high return on investment.

But it is also risky, which is why not everyone succeeds. There are many reasons for this, but the main ones are knowledge and experience.

It is an intelligent way to make your money grow, but for fledgling investors property investment can be a steep learning curve.

If you believe 2021 is your year to start your real estate portfolio, here are some of the basics you will need to know.

Before you invest

There is a lot of work to be done long before you can even think of looking at potential investment properties.

Without careful planning, expensive mistakes could end your real estate investment career before it begins. Follow these tips before you purchase any property.

Knowledge is key. So, spend three to six months learning the basics of real estate investment. Turn yourself into a sponge and absorb as much information as you can.

Read books, blogs and magazines, listen to podcasts and seminars and watch videos on YouTube. The quickest, most efficient way is to find a mentor who can tell you from firsthand experience what to avoid as a first-time investor.

Once you feel you have gained sufficient information, it is time to act. There is no point in doing the research if you do not act on what you have learnt.

Now that you have learnt the basics of property investment, the next step is to come up with an investment plan. As the saying goes, if you fail to plan, then you plan to fail. A plan will keep you on track and ready to face any surprises.

Like a business plan, long-term and short-term goals need to be identified before you decide on the strategy that will work best to achieve your goals. There are many courses of action you can take in real estate investment, but not all of them will provide the best results. Consider the pros and cons of each strategy before making a decision.

More importantly, you need to prepare a financial plan before you make your move. How much money can you put in and how will you finance it?

How much do you expect to profit? Will you play safe, or will you take more significant risks for bigger returns?

Choose the best strategy to complement your goals.

Property investing can be challenging for a beginner as it involves many steps that are crucial to every transaction. For instance, property prices can fluctuate and there is a risk of making poor investment choices if you are not careful. Investors should have a long-term focus for their investment strategy.

The most successful investors understand that it is impossible to do everything on your own. That is why they have a team of property professionals to help them with the different aspects of their real estate business.

Maximise the return-on-investment potential by establishing a reliable and competent team, which can include a real estate agent, home inspector, valuer, accountant, real estate attorney, property manager and so on. At the start, you may not need them all on your team, but as your portfolio grows, you may need to bring more real estate professionals on board.

Or, you can outsource some tasks. This will not only save time, it can help make up for your lack of experience. But always remember to do your due diligence to ensure you are engaging and working with a competent and trustworthy circle of people.

Finding a good property investment in 2021

First of all, you need to select the right property market. Remember the mantra “location, location, location”.

The location has a significant impact on the return on investment of an income property. You must perform a thorough property market analysis even before you begin your property search.

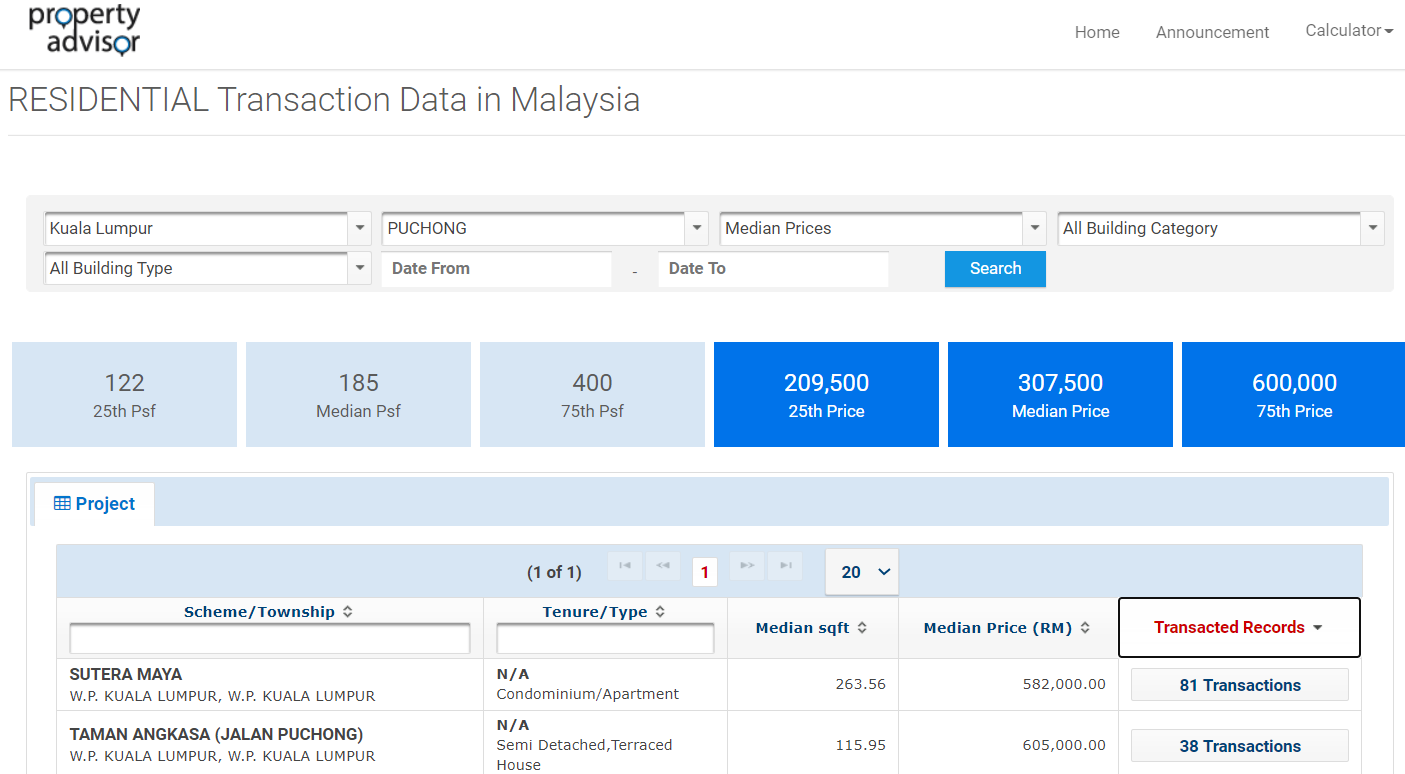

Finding a profitable area to invest in does not have to be challenging and time-consuming. Property Advisor is a great tool to help beginners get started.

Source: FMT News

POST YOUR COMMENTS